stock option tax calculator uk

Open an Account Now. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

Income Tax Service Inglewood Ca 4mba Income Tax Income Tax Service Tax Services Income Tax

The 42 best Stock Option Tax Calculator Uk images and discussions of May 2022.

. The Stock Option Plan specifies the total number of shares in the option pool. Non-tax favored Options UK ISO US. Ad With extended global trading hours trade nearly 24 hours a day 5 days a week.

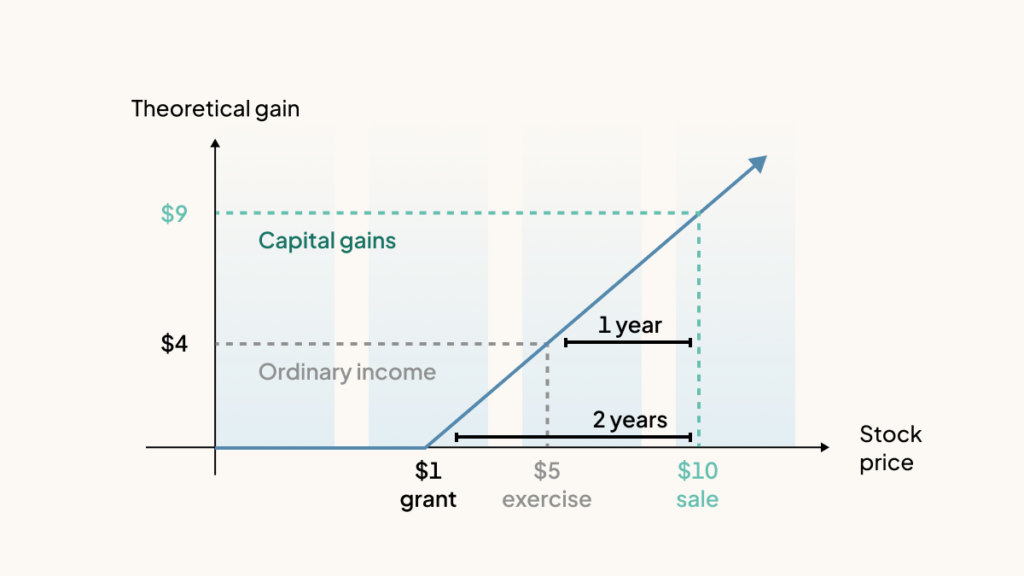

Restricted Stock UK Summary. Equity option positions held for less than a year result in short-term capital gains treatment. Per IRS Topic 409 if you trade in.

Ad Gain access to the Nasdaq-100 Index at 1100th the notional value. Non-Qualifying Stock Option NSO This is the most common form of option. In particular stock trading tax in the UK is more straightforward.

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21. What could an emergency interest rate hike mean for the stock market. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

The Free Calculator Helps You Sort Through Various Factors To Determine Your Bottom Line. I went though a similar process last year with my stock options were forcibly exercised when we were acquired. The grant and vest of the shares follow the description above and neither of these are taxable.

Per IRS Topic 409 if you trade in LEAP long-term equity anticipation options and hold the position. The Stock Option Plan specifies the total number of shares in the option pool. You can deduct certain costs of buying or selling your shares from your gain.

Ad With extended global trading hours trade nearly 24 hours a day 5 days a week. The rate of CGT on the disposal of the shares in the UK can be as low as 10 per cent. Ad Calculate Your Potential Investment Returns With the Help of AARPs Free Calculator.

The issue of stock options under an advantageous plan should also mitigate any social security payable by. Stamp Duty Reserve Tax SDRT when you. Lets get started today.

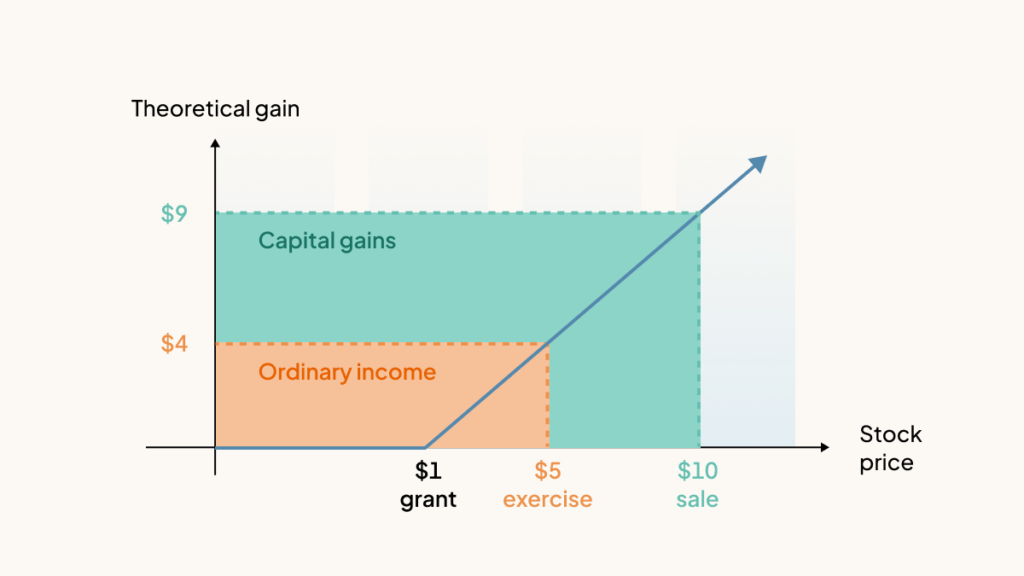

On this page is an Incentive Stock Options or ISO calculator. The Stock Option Plan specifies the employees or class of employees eligible to receive options. Alice now has a tax liability on the 25000 worth of stock which is taxed at the ordinary income rate.

Stock option tax calculator uk Friday May 6 2022 Edit. The 42 best Stock Option Tax Calculator Uk. Get Started In Your Future.

60 of the gain or loss is taxed at the long-term capital tax rates. Fees for example stockbrokers fees. Find A One-Stop Option That Fits Your Investment Strategy.

An easy and capital efficient way to gain exposure to the broad US. An easy and capital efficient way to gain exposure to the broad US. Only for employees tax favored treatment which is as low as 10 percent if the option is held for two.

Your source for the latest on options and the most innovative companies to invest in. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. - 26 September 2022 This FTSE 100 stock ROSE despite the market fall.

Ad Were all about helping you get more from your money. The 49 best Stock Option Tax Calculator images and discussions of March 2022. The rate of CGT on the disposal of the shares in the UK can be as low as 10 per cent.

Section 1256 options are always taxed as follows. If the scheme is unapproved then any money you.

Get Taxation Law Assignment Help And Writing Service From Professional Australian Writers Of Myassignmenthelpau At Online Taxes Check And Balance Business Tax

Iq Option Fees And Commissions Money Laundering Tax Services Audit

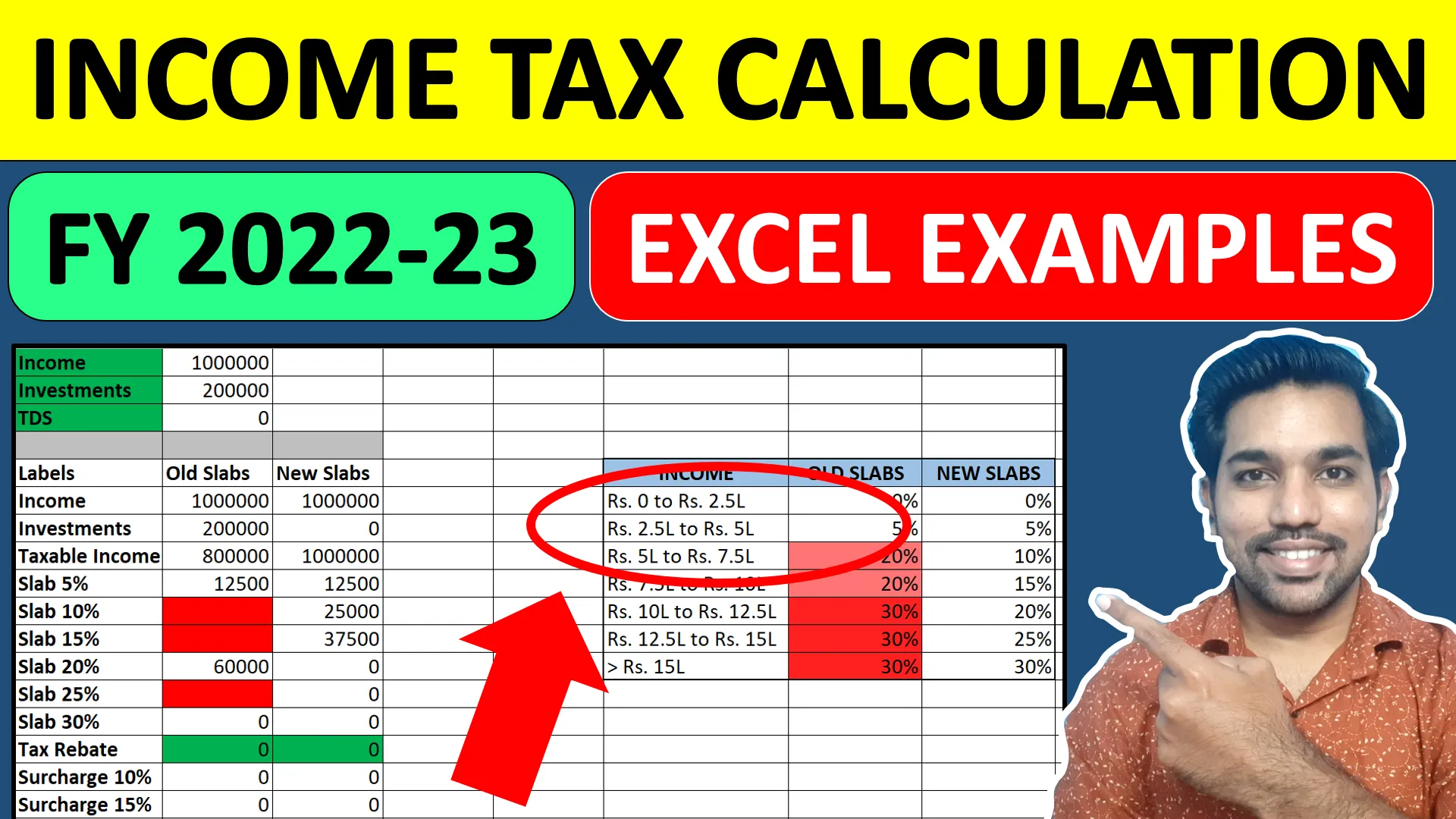

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download Fincalc

How Stock Options Are Taxed Carta

Long Term Capital Gain Tax Calculator In Excel Financial Control

Income Tax Calculator Fy 2022 23 For New And Old Regime Tax

Long Term Capital Gain Tax Calculator In Excel Financial Control

A Visual Guide To Employee Ownership Employee Stock Ownership Plan Journey Mapping Selling A Business

Small Business Accountancy Services In The Uk Are Highly Affordable Mutuals Funds Equity Fund

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Income Tax Calculator Fy 2022 23 For New And Old Regime Tax

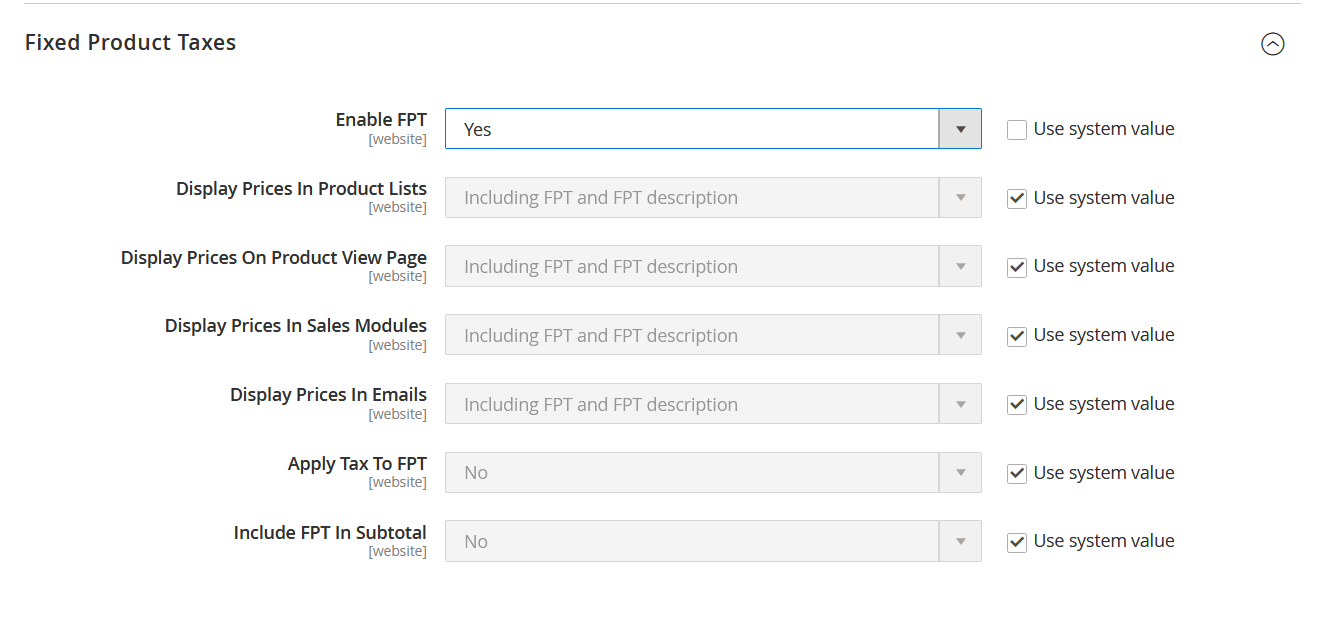

General Tax Settings Adobe Commerce 2 4 User Guide

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download

How Stock Options Are Taxed Carta

Income Tax Calculator Python Income Tax Income Tax

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Tax Checklist

Esops Rising Post Budget As Startups Do The Math Budgeting Start Up Wealth Creation