estate tax exemption 2022 inflation adjustment

The exemption for gifts and property is unified which means that it includes both taxable life gifts of an individual and taxable property in the event of death. The basic exclusion amount for estates of decedents who die during 2022 is 12060000 up from 11700000 for estates of decedents who died in 2021.

The Estate Tax On Stocks And Dividends Intelligent Income By Simply Safe Dividends

On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000.

. As of January 1 2022 that will be cut in half. As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in 2021. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation.

The changes are as follows. The Internal Revenue Service recently issued Revenue Procedure 2021-45 providing calendar year 2022 inflation adjustments for more than sixty tax provisions. The IRS has announced the 2022 inflation adjustments for many tax provisions including exemptions for estate gift and generation-skipping transfer taxes and the annual exclusion amount for gifts.

It consists of an accounting of everything you own or have certain interests in at the date of death refer to. The alternative minimum tax exemption for estates and trusts will be 26500 was 25700 and the phaseout of the exemption will start at 88300 was 85650. Therefore as of 2022 the estate tax exemption for an individual is 1206 million.

The IRS recently issued the 2022 inflation adjustments for various tax provisions including increased exemption amounts for the estate gift and generation skipping transfer taxes and an increase to the annual exclusion amount for gifts made in the 2022 calendar year. Federal Estate Tax Exemption As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in. Maximum 15 Rate Amounts 2.

The increase to the basic exclusion amount the BEA to 12060000 and the increase to the gift tax annual exclusion amount to. If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to estate tax. The IRS has released annual inflation adjustments for 2022.

Taxpayers to begin in tax year 2022. These include increased gift estate and generation-skipping transfer tax GST exemptions and annual gift tax exclusions. The lifetime estate gift and generation skipping transfer tax exclusion amount increased to 126 million.

The annual inflation adjustment for federal gift estate and generation-skipping tax exemption increased from 117 million in 2021 to 12060000 million in 2022. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. The gift and estate tax exemption and GST exemption increased to 12060000 for an individual from 11700000 in 2021.

Following our September posting of a preview of the 2022 estate tax exemptions the IRS recently released the inflation-adjusted amounts that will apply in 2022. In addition beginning on January 1 2022 the amount of the federal gift tax annual exclusion the amount a person can give to a recipient other than. For married couples the exclusion is now 24120000 million.

2022 Federal Exemption Estate Tax. On November 10 2021 the IRS released tax inflation adjustments for 2022. 2022 Annual Adjustments for Tax Provisions.

The alternative minimum tax exemption for single filers is 75900 and begins to phase out at 539900. Two of these adjustments are of particular interest to estate planners. The alternative minimum tax exemption for estates and trusts will be 26500 was 25700 and the phaseout of the exemption will start at 88300 was 85650 and the phaseout be complete at 194300 was 188450.

The amount is adjusted each year for inflation so. In 2021 the exemption amount was 73600 and began to phase out at 523600. Alternative Minimum Tax Exemption for Single Filers.

Marginal Tax Rates. Estates of decedents who die during 2022 have a basic exclusion amount of 12060000 up from a total of 11700000 for estates of decedents who died in 2021. The annual exclusion for gifts is 16000 for calendar year.

Some of the inflation-adjusted tax brackets rates deductions exemptions and exclusions that affect most US. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022. The federal estate tax exemption is going up again for 2022.

Federal Estate Tax Exemption. This means that a married couple. The tax rate applicable to transfers above the exemption is currently 40.

The foreign earned income exclusion for tax year 2022 increased to 112000 up from 108700 for tax year 2021. The federal lifetime gift tax exemption has been indexed for inflation and therefore increased from 11700000 in 2021 to 12060000 in 2022. Lower Estate Tax Exemption.

On November 10 2021 the IRS released tax inflation adjustments for 2022. Transfer tax exemption for lifetime gifts death transfers and generation-skipping transfers. Estate and gift exclusions.

Up from 117 million for 2021. The estate tax exemption is adjusted for inflation every year. The Internal Revenue Service will publish the official inflation adjustments in a Revenue Procedure that will probably appear in 4-8 weeks.

The excess taxable income above which the 28 percent rate applies will be 206100 was 199900. As of early 2022 the exemption amount is 1206 million. Notably the federal estate and gift tax exemption amount will increase from 117 million to 1206 million beginning January 1 2022.

Individual other than estate or trust 41675. For couples the exclusion is now 2412 million. November 10 2021.

The personal exemption for tax year 2022 remains at zero. The federal estate tax exemption for 2022 is 1206 million. The inflation rate adjustment for this years property taxes in Michigan is 33 less than a maximum 5 allowed under Proposal A but it.

The irs adjusts the federal transfer tax exemption amounts for inflation each year.

2020 Estate Planning Update Helsell Fetterman

Estate Tax Definition Federal Estate Tax Taxedu

How Could We Reform The Estate Tax Tax Policy Center

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

What Happened To The Expected Year End Estate Tax Changes

Biden Greenbook Estate Tax Proposals Should You Care

Inheritance Tax Definition Taxedu Glossary Terms

Estate Tax Examples Of Estate Tax Estate Tax Rate

New York Estate Tax Everything You Need To Know Smartasset

Estate Tax Exemption 2021 Amount Goes Up Union Bank

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

What Are Estate And Gift Taxes And How Do They Work

Eight Things You Need To Know About The Death Tax Before You Die

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Where Not To Die In 2022 The Greediest Death Tax States

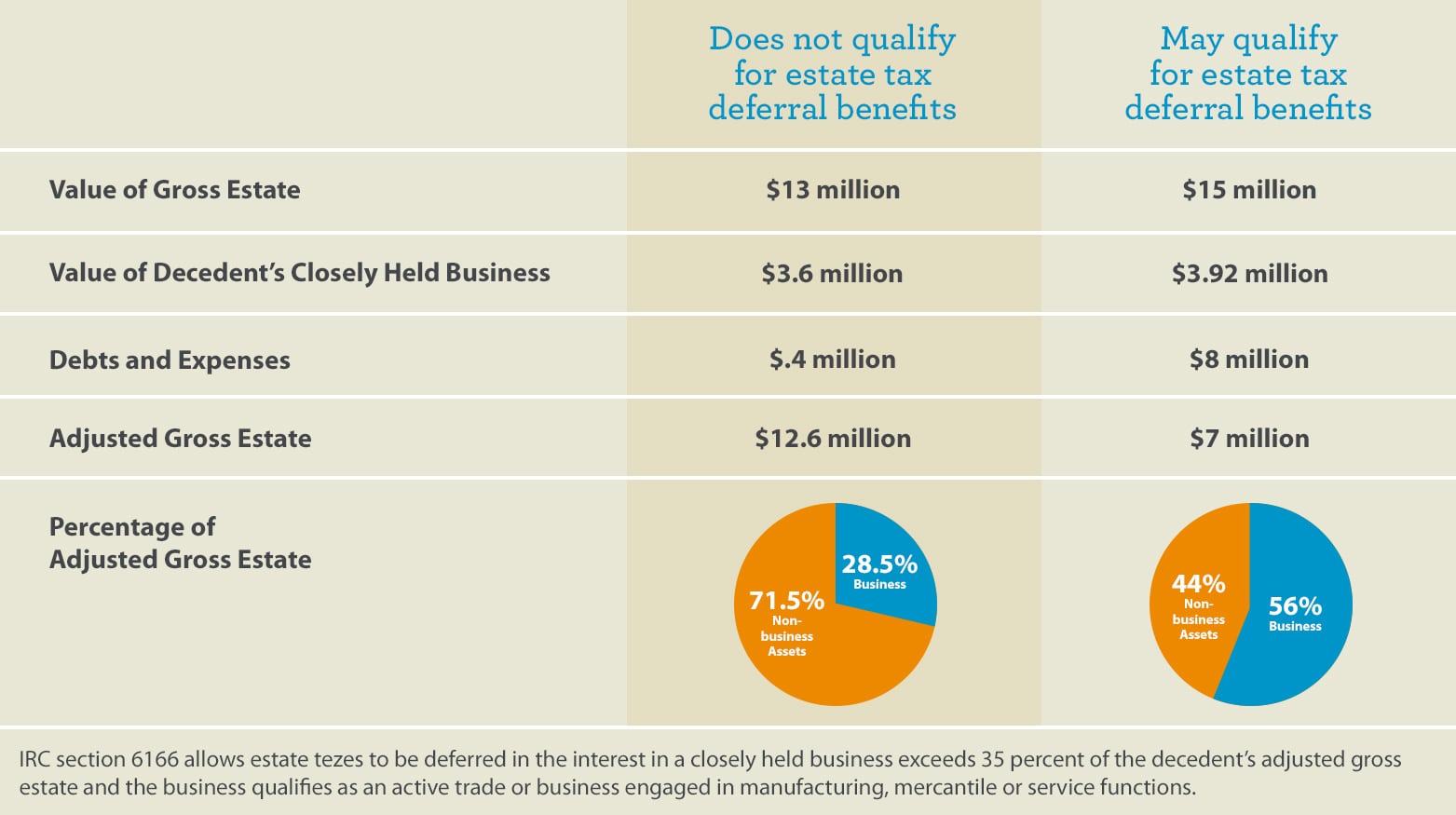

Estate Taxes On A Closely Held Business Under Irc 6166 Wells Fargo Conversations